What is accounting and accounting strategy?

Accounting is a systematic process of summarizing and reporting financial transactions and information of an organization. It involves maintaining and managing financial records, such as ledgers and financial statements, to ensure accurate financial reporting and compliance with accounting standards and regulations.

Accounting strategy, on the other hand, refers to the planning and implementation of financial management practices to achieve an organization’s financial goals and objectives. It involves developing and executing a plan to effectively manage financial resources, optimize profitability, reduce risks, and enhance the organization’s financial performance.

An accounting strategy typically includes determining financial objectives, identifying key performance indicators (KPIs), establishing financial policies and procedures, implementing accounting controls, and ensuring compliance with accounting regulations and standards. It is an essential component of overall business strategy as it enables an organization to effectively manage its financial resources and make informed decisions based on financial data and analysis.

How accounting stimulates growth

Accounting in general can help businesses make informed decisions, manage cash flow effectively, plan for the future, and reduce tax liability. All of these factors can help stimulate growth and drive business success. But being a growth company you might have to adjust your strategy depending on the stage you are in.

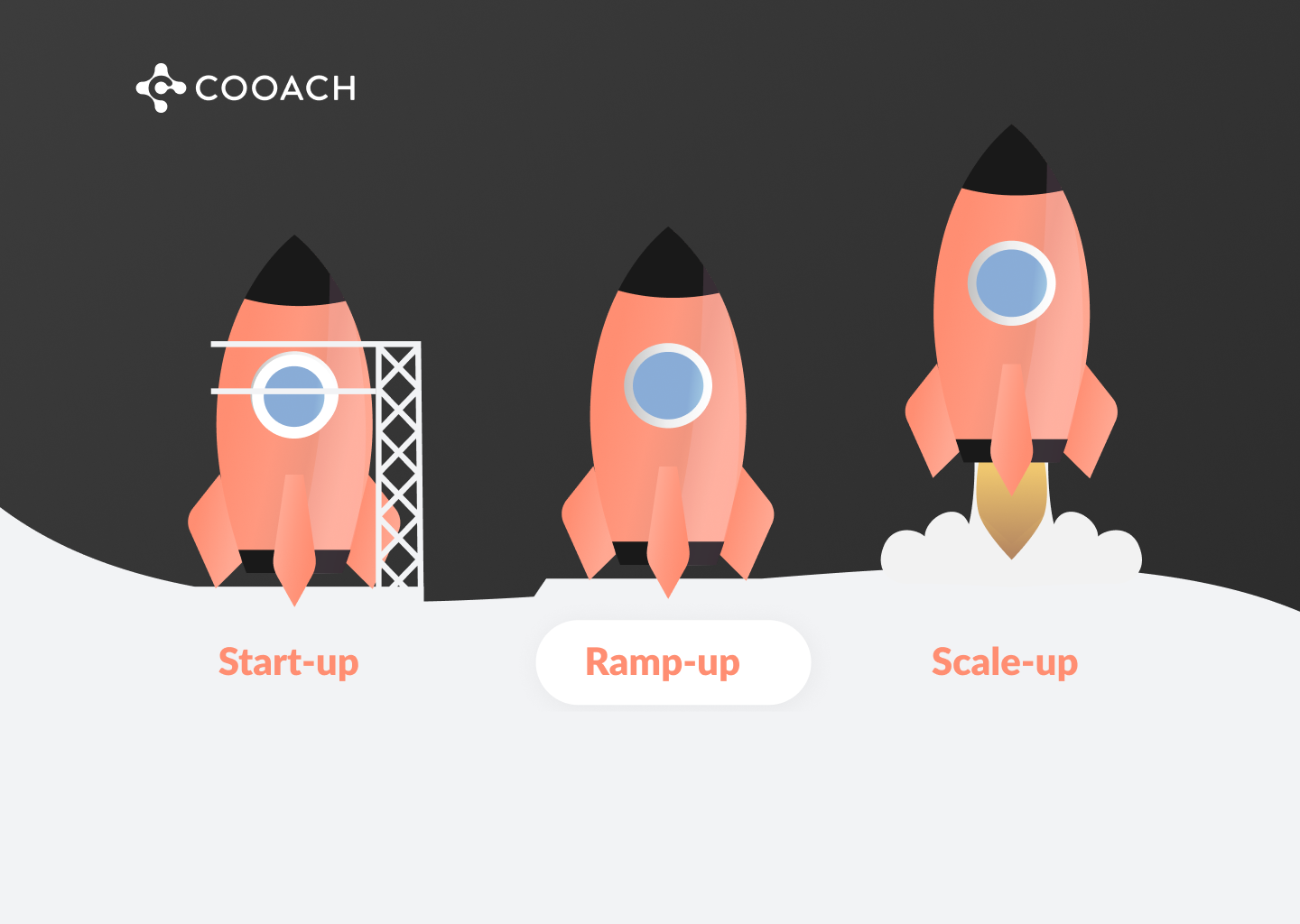

What are the stages a growth company goes through?

Some of the most common terms used when talking about different growth stages are start-up, ramp-up and scale-up and those are the terms we use at Cooach and will use going forward in this article.

The start-up stage

A start-up is a newly created company that is in the process of developing a product or service, finding its target market, and establishing its business model. Start-ups typically operate with a small team of founders and may have limited funding or resources. The goal of a start-up is to validate its business concept and achieve a sustainable level of growth.

The ramp-up stage

Ramp-up is the stage of a company’s growth where it starts to expand its operations, increase its production or service capacity, and attract more customers. This stage usually involves hiring more employees, investing in equipment and technology, and establishing partnerships and collaborations. The goal of ramp-up is to reach profitability and achieve economies of scale.

The scale-up stage

Scale-up is the stage of a company’s growth where it experiences exponential growth, rapidly expands its operations and revenue, and enters new markets. This stage requires significant investment in human and financial resources, as well as effective management and leadership. The goal of scale-up is to become a market leader and establish a sustainable competitive advantage.

Accounting in the different stages

Overall, accounting is a crucial aspect of any business, and it is important to take it seriously from the early stages of your company’s development. By keeping these considerations in mind, you can establish a strong foundation for financial success and growth.

Accounting in the start-up stage

- Set up a robust accounting system with possibilities to expand. We have a few tips further down in this article.

- Create a budget and forecast your financials regularly.

- Ensure tax compliance by registering for tax numbers and filing tax returns.

- Maintain accurate records of all financial transactions.

- Seek professional advice from a qualified accountant or bookkeeper.

Accounting in the ramp-up stage

- Establish a proper accounting system that is appropriate for your company’s size and industry.

- Manage cash flow to ensure you have enough funds to cover expenses, bills, and growth opportunities.

- Maintain accurate records of all financial transactions.

- Ensure tax compliance by registering for tax numbers and filing tax returns.

- Prepare regular financial reports, including income statements, balance sheets, and cash flow statements.

- Seek professional advice from a qualified accountant or bookkeeper.

Accounting in the scale-up stage

- Review and improve your accounting system to ensure it can accommodate your company’s growth.

- Implement robust cash flow management practices.

- Prepare regular financial reports, including income statements, balance sheets, and cash flow statements.

- Conduct regular audits to ensure accuracy and compliance.

- Manage tax planning and compliance for domestic and international operations.

- Seek professional advice from a qualified accountant or financial advisor.

Leverage technology for financial management

Technology has transformed the way businesses manage their finances. By leveraging the latest accounting software and tools, you can streamline your financial processes, automate accounting tasks, and gain real-time visibility into your company’s financial performance. This can help you make informed decisions, optimize cash flow, and manage financial risks more effectively.

What to look for when scouting for financial management software

Choose software that meets your business needs: When selecting financial management software, it’s important to choose a solution that meets the specific needs of your business. For example, if you have a large inventory of physical goods, you might need software that can help you track and manage your inventory levels, while if you offer services, you might need software that helps you manage client billing and invoicing.

Look for software that integrates with your other tools: Consider software that integrates with other tools you use in your business, such as your customer relationship management (CRM) system or your point-of-sale (POS) system. Integration can help streamline processes and reduce the need for manual data entry.

Check for ease of use: The software you choose should be easy to use and navigate, even for those without extensive financial management experience. This can help reduce errors and ensure that your financial data is accurate.

Evaluate the software’s reporting capabilities: Good financial management software should offer robust reporting capabilities that provide insights into key financial metrics. Ensure the software you choose offers the reports you need to monitor and analyze your business’s financial health.

Consider cloud-based solutions: Cloud-based financial management software can offer several advantages over traditional, locally installed software. For example, cloud-based software can be accessed from anywhere with an internet connection, which can be useful if you have remote team members or need to work on the go.

Look for security features: Any financial management software you choose should have strong security features to protect your financial data from unauthorized access or breaches.

Tips on software that could live up to above standards

Fortnox: Fortnox is a cloud-based accounting software solution with flexible functions that help you book, receive payments and find new customers. It has automatic connections to banks, authorities, and other systems, which makes your business more efficient. With Fortnox, there are opportunities to shape the range depending on your company’s needs.

Anfix: Anfix is also cloud-based. It is accessible from anywhere and with any browser with the tools you need to manage your company, such as billing, collections, and document storage, among others.

In a fast, simple and secure way you can create electronic invoices, budgets, orders, keep track of collections, payments, etc.

Do you need help with accounting?

At Cooach we help growth companies by offering Business Support services. Accounting is one of the services we offer within Finance.

Cooach Accounting services are designed to streamline your bookkeeping process and ensure accuracy in records. We handle all aspects of your accounting, from daily bookkeeping updates to period closings. This allows you to have access to up-to-date financial information and the ability to make informed decisions for your business. We also ensure compliance with all regulations and reconciliations of specific accounts such as a bank, tax authority, accounts receivable, and accounts payable. With Cooach’s accounting, you can focus on core business while we take care of the numbers.

As a Cooach client, you can access templates, Q&A, and expert help via Slack. If you are not already a customer, you can still register for a free account and enjoy our template library.

Here you can log in or register an account, free or paid, depending on your current needs. https://cooach.io/en/signup/